In recent years, the financial landscape in India has undergone a remarkable transformation, with technology playing a pivotal role in reshaping the way businesses manage their finances. Business-to-business (B2B) fintech companies have emerged as key players in this financial evolution, offering innovative solutions to streamline processes, enhance efficiency, and drive growth. The rise of financial technology, or fintech, has revolutionized the way businesses manage their finances, paving the way for a more efficient and interconnected ecosystem.

In India, a burgeoning hub of innovation and entrepreneurship, B2B fintech companies have played a very important role in shaping the country's financial evolution. Here in this blog, we will be exploring top B2B fintech companies in India, B their contributions to the financial sector, and their impact on the broader economy. So let us start and first understand what B2B Fintech is.

Understanding B2B Fintech

B2B fintech refers to financial technology companies catering to businesses, not consumers. They use technology to optimize financial processes like payment processing, invoicing, and payroll management for other businesses. Essentially, B2B fintech aims to improve the efficiency, security, and overall effectiveness of financial operations for business-to-business transactions and financial management.

The Fintech Revolution in India

The Fintech revolution in India is a testament to the transformative power of technology in the financial sector. Over the past decade, India has experienced a significant surge in financial technology innovations, reshaping the way people access and manage their finances. This revolution has touched various aspects of the financial ecosystem, from digital payments and lending to insurance and wealth management.

The FinTech industry in India is not only making a significant impact on the under-served sections of society but is also thriving in one of the world's most dynamic markets. With more than 50% of the Indian population now using the internet, the digital revolution is in full swing. According to the reports, the average data consumption per month in India currently stands at 20 GB, a figure that is projected to rise to approximately 47 GB/month by 2027. Impressively, Indian mobile data consumption has surpassed the combined figures of the USA and China.

So, we hope now you have an idea about B2B fintech and how the Fintech revolution in India has emerged, now it’s time to get into the details of the top 10 FinTech companies in India at present, exploring their innovative approaches and contributions to reshaping the financial landscape.

Top B2B Fintech Companies in India

1. Neokred:

Neokred is a fintech company that allows corporations, fintech's, and startups to start their banking services with the help of modified tools. The Neokred Dashboard provides users with real-time visibility of their transactions, customer data, and expense records in an analytical format for better visibility and decision-making. One can manage business spending at the tip of their finger and set up customized controls unique to their company card while issuing.

2. Perfios:

Perfios is a leading SaaS B2B FinTech organization, that envisions an ecosystem where real-time data drives financial decisions. Leveraging cutting-edge Artificial Intelligence and ML algorithms, Perfios empowers global financial institutions to make well-informed choices. Trusted by over 900 banks & FIs, their AI-powered solutions specialize in real-time insurance claims, credit decisions, fraud control, and more, making them instrumental in supporting other FinTech companies in India.

3. PayTm:

PayTm is an acronym for Pay through Mobile, is a pioneer and one of India's most popular payments FinTech companies. Initially a mobile wallet provider, PayTm expanded into offering banking, lending, and insurance services. Processing over 5 million daily transactions, with 450 million registered users and 60 million bank accounts under its PayTM bank, PayTm stands as a key player in India's digital economy.

4. LendingKart:

LendingKart is a top Fintech company, that excels in providing lending solutions as its name suggests. Categorizing their digital lending services into Business Loans, Working Capital Loans, MSME, SME loans, and special business loans for Women, LendingKart has earned a competitive edge in the market. With online approval and quick sanctioning, they offer collateral-free loans with flexible repayment options, serving as a go-to option for many businesses.

5. Zerodha:

Zerodha tops the list of wealth management Fintech companies in India. As an online platform for investing in stocks, mutual funds, and more, Zerodha's user-friendly interface and commission-free mutual funds have gained a loyal investor base. Registered with SEBI & CDSL, Zerodha ensures legitimacy and offers a variety of financial tools, making investing accessible to all.

6. DMI Finance:

Operating since 2008, DMI Finance has evolved into one of India's top FinTech companies, specializing in digital underwriting and loan management. Working primarily with B2B FinTech organizations, they offer services such as business loans, housing finance, and asset management. Regulated by RBI, DMI Finance provides reliable lending solutions to those seeking top FinTech companies in India.

7. Satya Microcapital:

Satya Microcapital aims to empower the underserved, specifically small businesses and low-income entrepreneurs. Providing lending facilities online, Satya Microcapital offers limited liability loans, micro business loans, consumer durable loans, and individual micro loans. Their mission to catalyze socio-economic development drives their efforts in supporting the underserved segment.

8. PhonePe:

PhonePe is one of the most renowned FinTech companies in India, boasting over 440 million users. As a digital payments and financial services provider, their UPI-based app offers a range of services, including money transfers, bill payments, fund investments, and more. Licensed by RBI, PhonePe has garnered numerous awards for its innovative services, recently incorporating the Account Aggregator system to ease loan access.

9. Acko:

Acko's digital-only model revolutionizes car insurance, providing users with a seamless experience to purchase insurance plans. Offering additional benefits like financial protection against medical emergencies, no room rent capping, and other personalized coverages, Acko stands out in the insurance sector.

10. Unnati:

Unnati is a top-notch Agri-Fintech organization that empowers farmers through digital technologies. By providing financing, yield insights, and correct advisory, Unnati optimizes farming practices, minimizing losses, and supporting farmers at every stage of the crop lifecycle.

11. Upstox:

Upstox is a newcomer in the FinTech arena that offers a low-cost online investment platform. With free equity delivery and a 3-in-1 account, Upstox provides affordable options for long-term and intraday investing. Their user-friendly platform and ease of IPO applications and mutual fund investments have earned them unicorn status in the FinTech division.

Impact of B2B fintech Companies on Financial Inclusion and Economic Growth

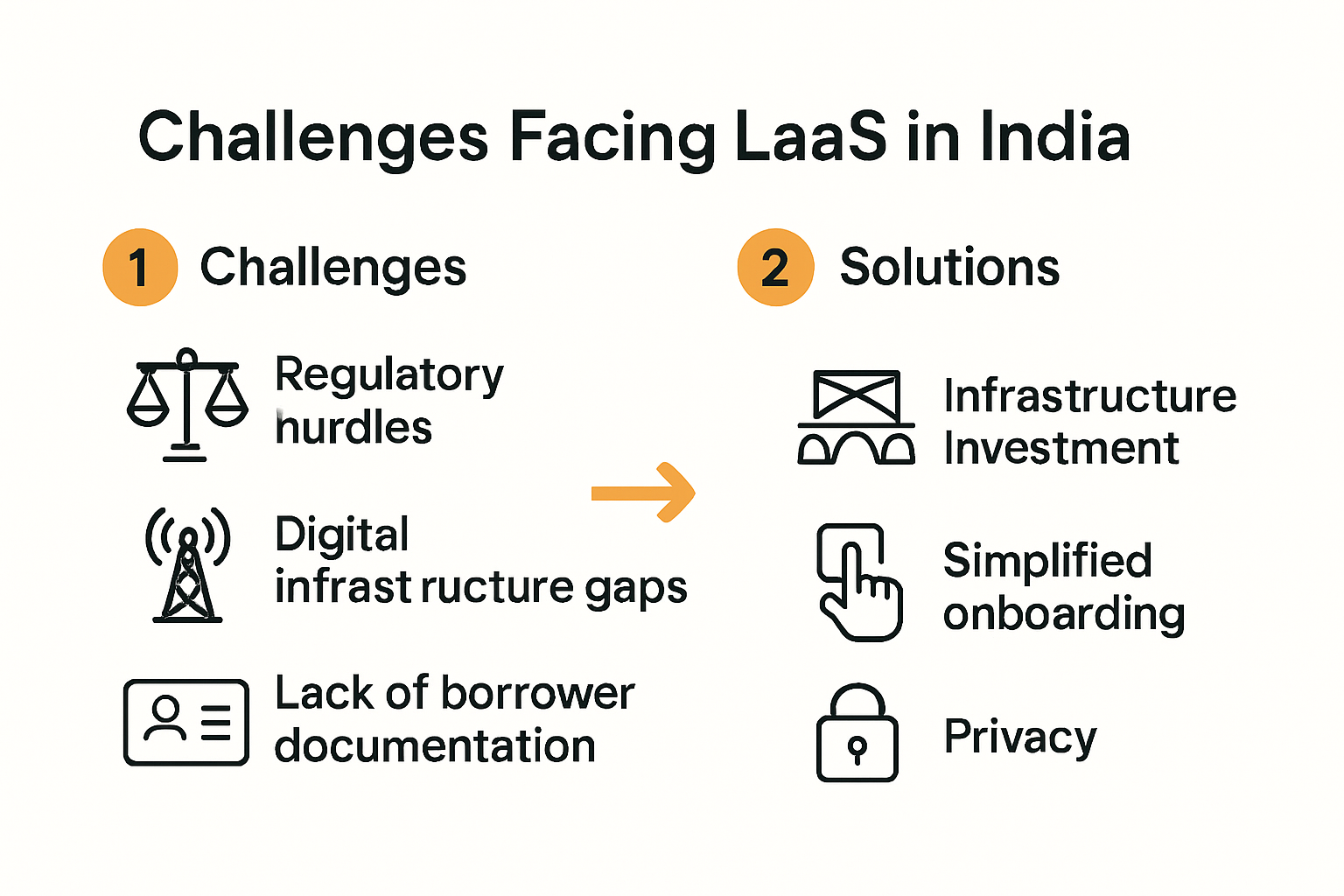

The proliferation of B2B fintech companies in India has not only transformed the way businesses operate but has also contributed significantly to financial inclusion and overall economic growth. By providing accessible and user-friendly financial solutions, these companies empower businesses of all sizes, including small and medium enterprises (SMEs), to participate more actively in the economy. While the B2B fintech sector in India continues to thrive, it faces its share of challenges. Regulatory complexities, data security concerns, and the need for constant innovation pose hurdles to the sustained growth of these companies. However, with challenges come opportunities. The evolving regulatory landscape provides a chance for collaboration between fintech companies and regulatory bodies to create a conducive environment for innovation.

The financial evolution driven by B2B fintech companies in India represents a transformative force that has reshaped the traditional financial ecosystem. B2B fintech companies are not just catalysts but they are architects of change, shaping a future where businesses operate in a seamlessly connected, technologically advanced, and efficient financial ecosystem. As India continues on this transformative journey, the impact of these pioneering companies will reverberate not just in boardrooms but in the very fabric of the nation's economic narrative. Financial evolution is not a destination but an ongoing journey toward a future where finance is not just a function but a force driving sustainable growth and prosperity.